Overwhelmed?

Feel Buried?

Hopelessness?

Financial Regret?

We are here to find

a way out for you.

Our mission

We understand that credit card debt can feel overwhelming.

Our mission is to provide expert guidance to individuals who find themselves drowning in financial obligations.

Whether it's developing a tailored repayment plan, exploring debt consolidation options, or debt settlement, our team of experienced consultants will do our best to advise you on the best path forward.

Why Choose Us?

When you’re drowning in debt, every dollar matters. That’s why our average client settles their debt at just 65% of the original amount owed — far below what other companies can offer.

Let’s be honest:

Most big-name debt relief companies – like National Debt Relief, Freedom Debt Relief, Accredited Debt Relief, CuraDebt, etc. – advertise great results. But dig a little deeper, and you’ll find their average settlement hovers around 80–85% of the original debt. That’s barely a discount.

We Beat Their Price — Guaranteed

If you can find a better settlement offer from any other provider, we’ll match it — and then go a step further:

We’ll include our Credit Score Handling Service (valued at $1,500) — completely free.

No Outsourcing. No Scripts. No Excuses.

Here’s what those other companies don’t tell you:

Many of them use offshore consultants from India, the Philippines, or worse, automated AI chatbots that don’t understand U.S. laws or the emotional stress of living with crushing debt.

These reps follow scripts. That’s all they have. No real solutions. No empathy. No experience with the U.S. financial system.

At Guided Financial Relief, You’re Talking to Real People, Right Here in the U.S.

Our team is 100% based in America. We understand your situation because we’ve been there, and we know how the U.S. credit system actually works.

No call centers. No pressure. Just results.

You’re not just a case number. You’re a person. And we’re here to help you get your life back — for less.

Proven Experience. Real Results.

25+

years of experience in helping clients overcome debt challenges

10 000+

accounts successfully settled

$100M+

settled in unsecured credit card debts

We've helped thousands just like you!

Here's how we do it:

Debt Settlement

A financial strategy designed to help individuals struggling with overwhelming unsecured debt.

This approach involves negotiating with creditors to reduce the total amount owed, often resulting in significant savings for the debtor.

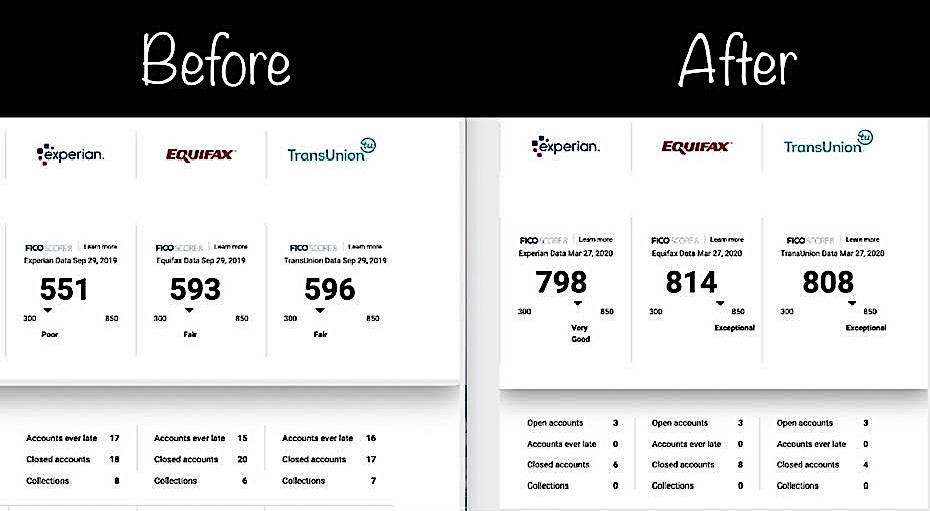

Improve Your Credit Score

Settling your debt doesn’t just provide immediate relief — it’s also a powerful step toward improving your credit score.

As your debt decreases, your credit utilization ratio improves, making you more attractive to lenders. This opens the door to better financial opportunities like:

✅ Lower interest rates on future loans

✅ Improved chances of mortgage or car loan approval

✅ Higher credit limits for greater financial flexibility

Financial Education

Meet Our CEO

With over 25 years of experience helping people navigate financial challenges, our CEO, Adjemian Vartan, has dedicated his career to making complex financial matters easier for everyday families and businesses.

He holds:

Bachelor’s degree in Business Administration and Finance: deep understanding of how financial businesses work.

Master's in Forensic Accounting, which means he’s not only good with numbers, but he also knows how to spot hidden problems and fix them, or how to protect clients. Forensic accounting means "financial detective" work.

Trained by the Department of Defense in financial systems, where precision and accountability are everything.

Certified FICO Analyst, which means he deeply understands how credit scores work—and how to improve them.

He’s helped thousands of people reduce debt, rebuild their credit, and find peace of mind.

When you work with us, you’re not getting a sales pitch—you’re getting real support from someone who knows how the system works and how to make it work for you.

Your Path to Financial Freedom

We understand that no two financial situations are the same. That’s why we provide a tailor-made roadmap designed to meet your unique needs and goals — both short-term and long-term.

Our programs focus on:

✔️ Ethical and effective debt settlement strategies

✔️ Accelerated payoff solutions to reduce debt faster

✔️ Expert guidance for managing your budget and improving financial stability

Take action to get and stay out of DEBT TODAY!

Free Consultation – No Obligation

Our consultation and estimations are 100% free with no commitment required. Simply choose a time that works for you and let us know how to contact you.

Welcome to our office:

628 Cleveland Street, STE A2, Clearwater FL 33755

Stay Informed, Stay Empowered.

Sign up for our email updates and gain access to:

✅ Expert tips on credit management

✅ Proven strategies for boosting financial health

✅ Insights to help you avoid future credit pitfalls

Subscribe and take control of your financial future — one smart decision at a time.